Equities give good returns over the long term? Not always.

Lot of financial planners assume equities give positive returns over long term which is usually defined as anything over 7 years and lot of times even 3-5 years is considered long term. Another assumption is to diversify equity portfolios across different markets. What these planners generally do-not account for are global downturns where multiple markets give negative returns over large periods of time.

In this article we show that are peaks (exuberance) of dot-com bubble there were two downturns; dot com crash and then global financial crisis which resulted in multiple large developed economies having more than decade of negative performance.

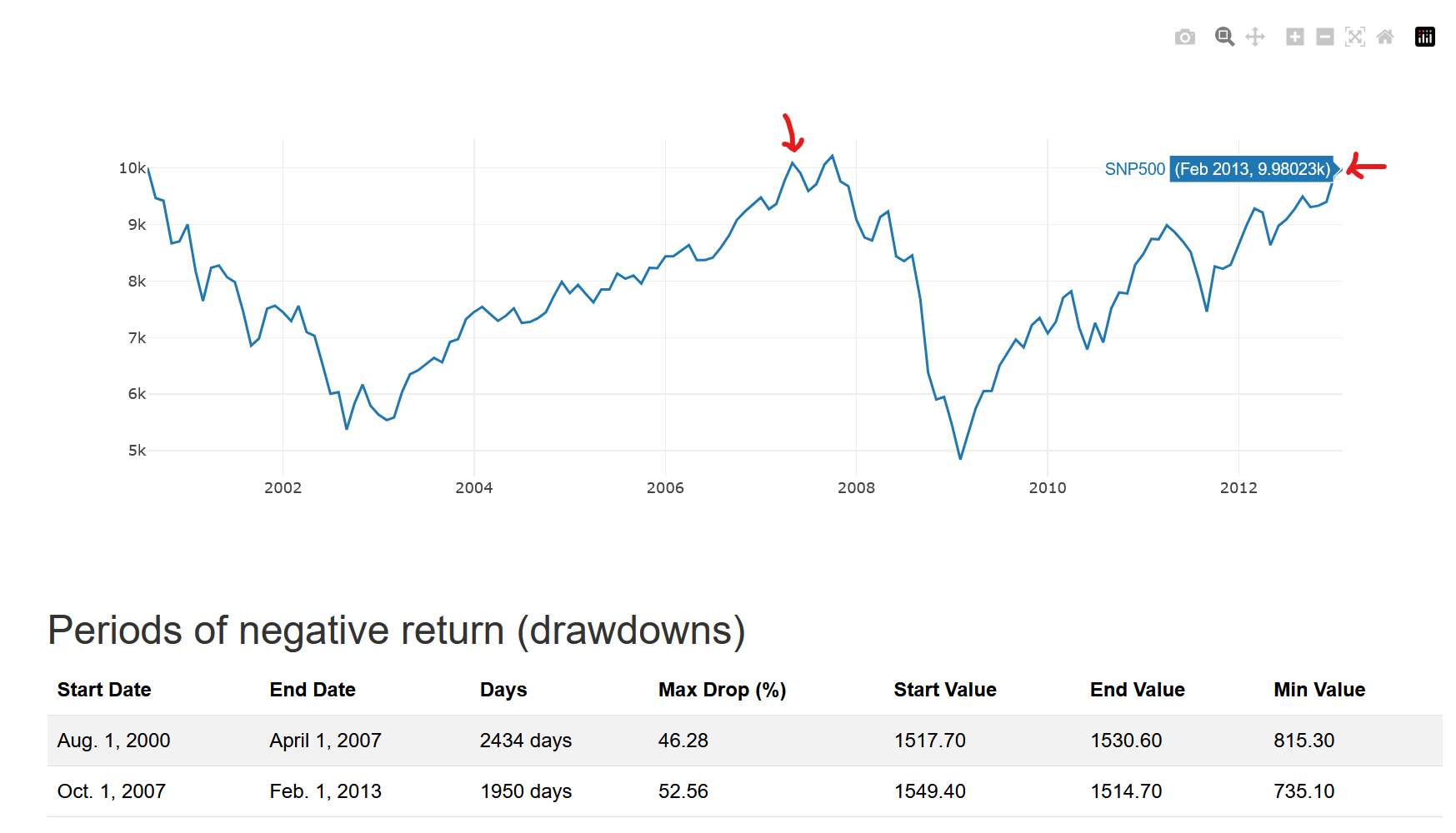

S&P 500

Even US markets were not spared and between 2000 to 2012, S&P 500 had negative returns. Accounting for dividends returns were flat or marginally negative. Accounting for inflation they were quite bad.

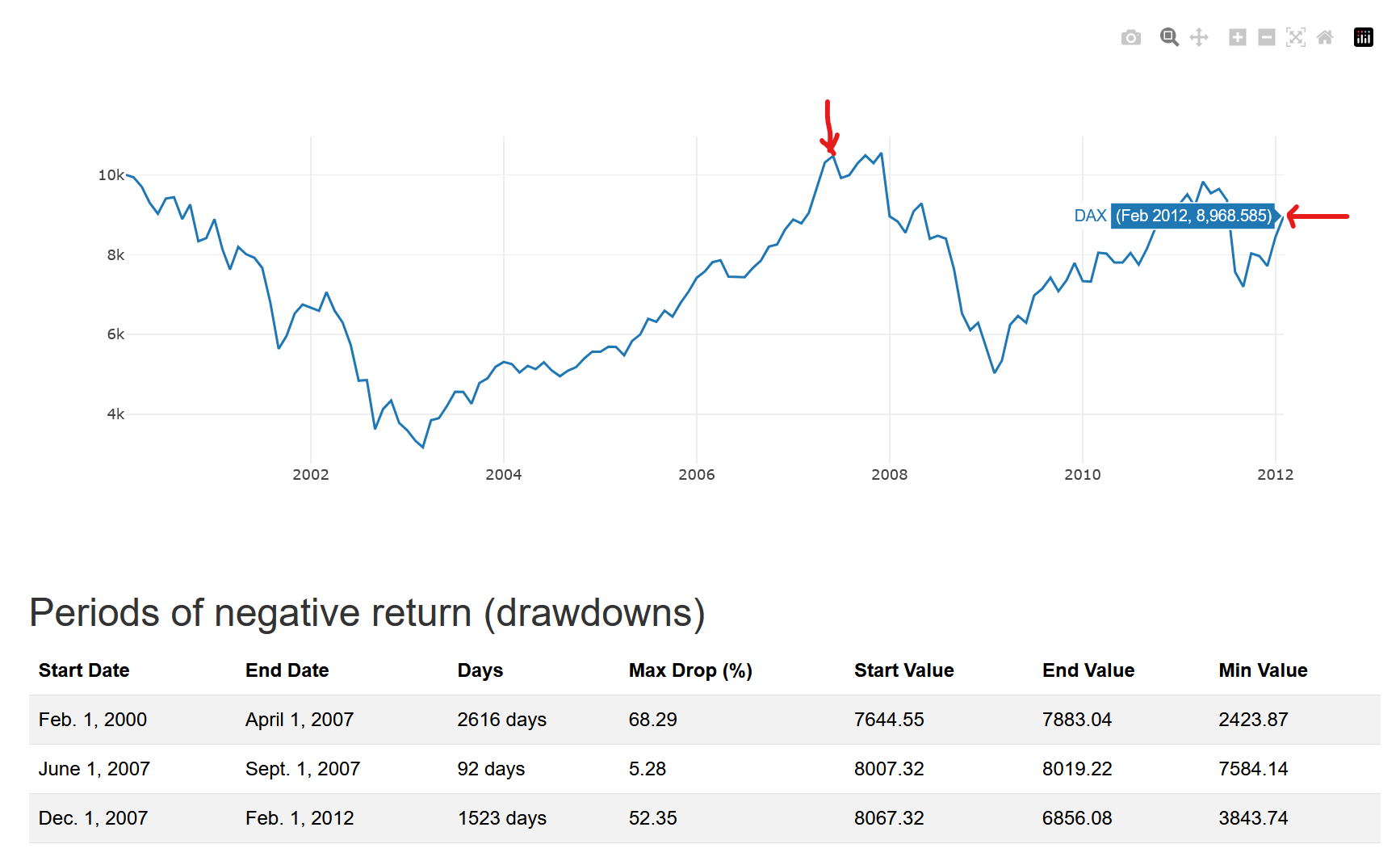

DAX

DAX, Index of 40 blue chip german companies, similarly had negative returns for more than 10 years. Accounting for dividends returns were flag or marginally negative. Accounting for inflation they were bad.

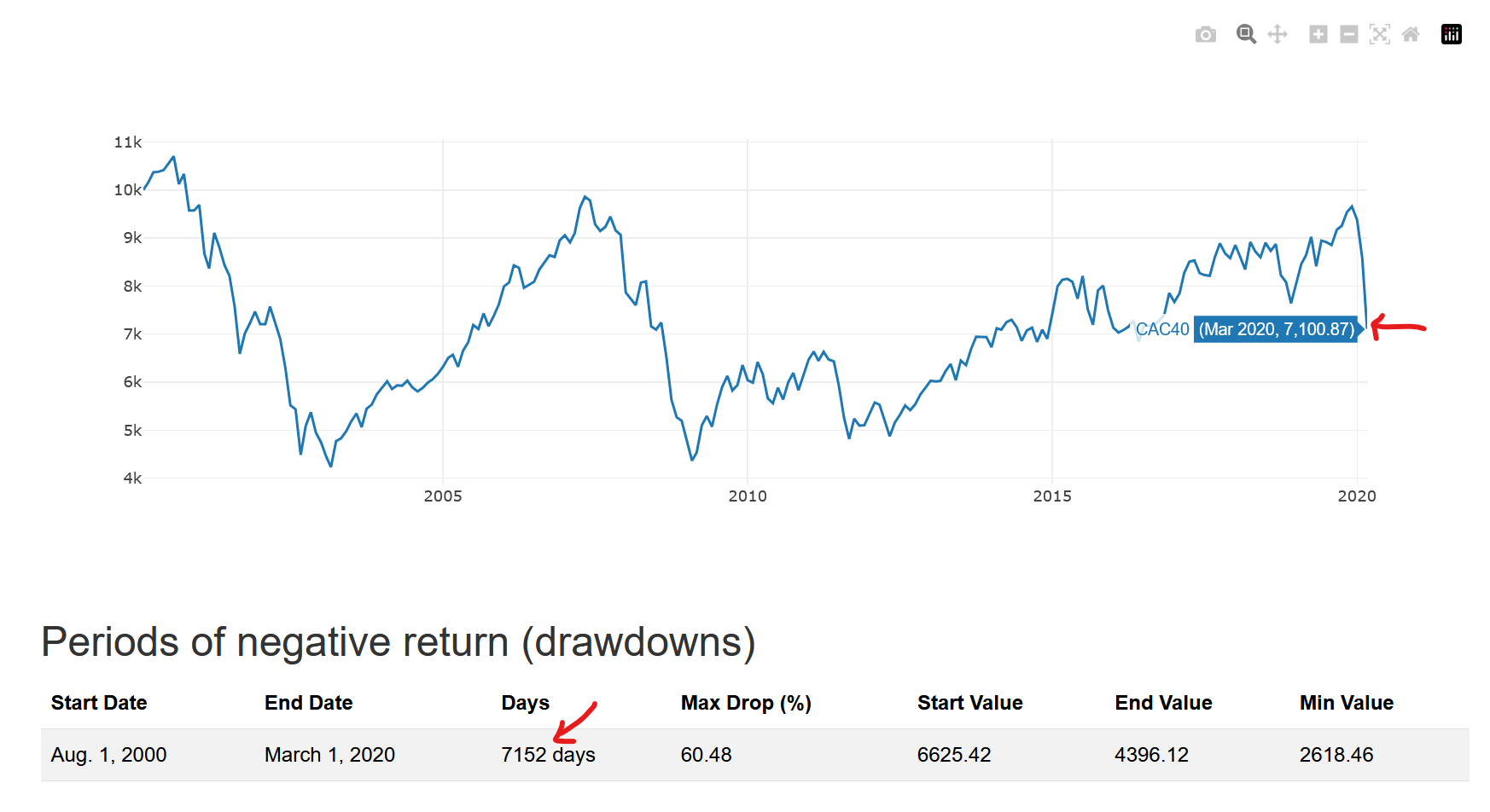

CAC 40

CAC 40, Index of 40 blue chip french companies, similarly had negative returns for more than 20 years. Infact after the dot com crash cac recovered only for global surge after pandemic.

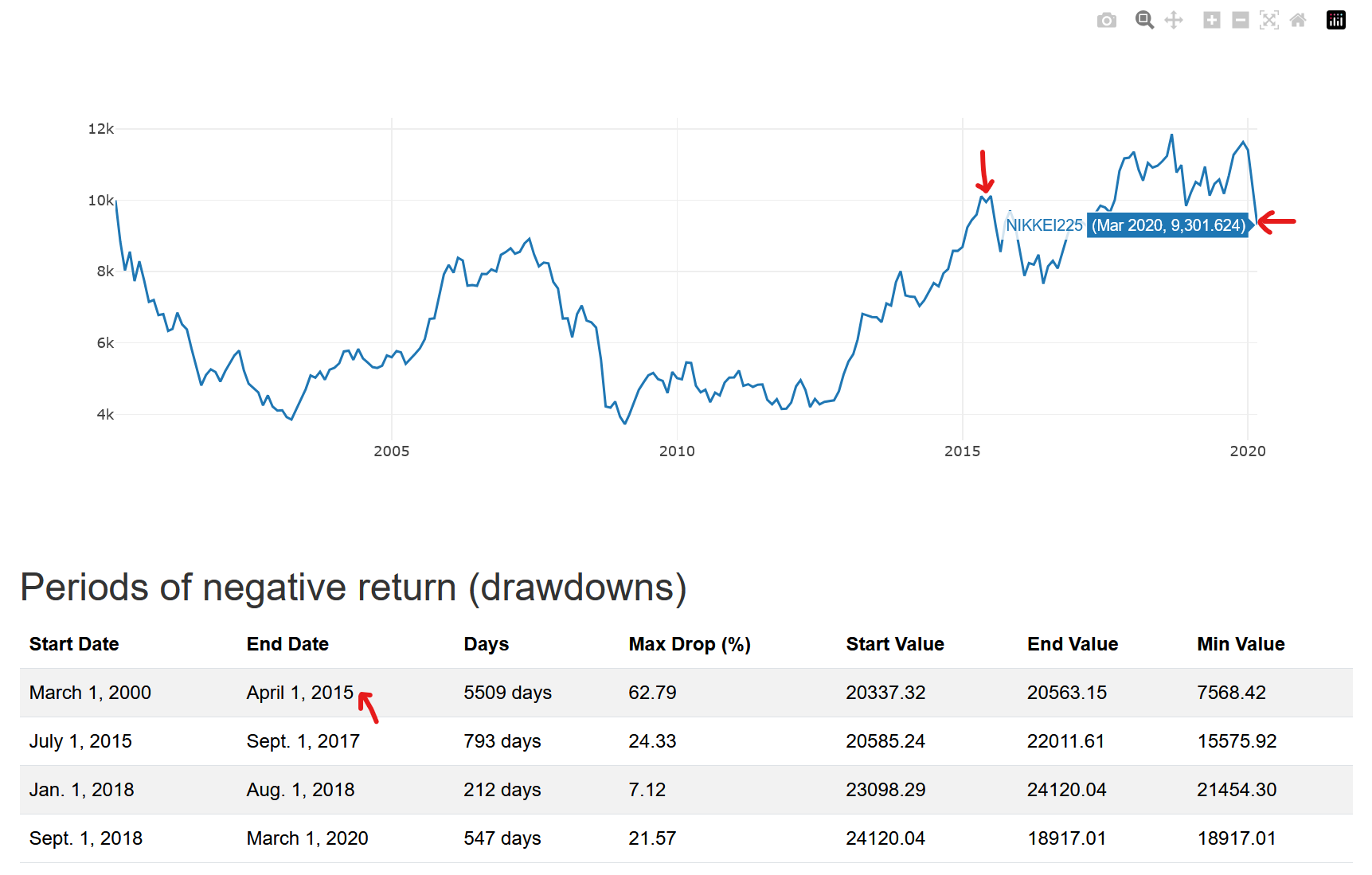

NIKKEI 225

Nikkei 225, Japanese index, had negative returns for more than 20 years.

Takeaways

So what are the takeaways from this data?

- Global crisis are more common than you think (dotcom crash, global financial crisis).

- Markets can be correlated so sometimes highs and lows rhyme.

- Do-not assume that you will get positive returns from markets in the long term.

- Be careful when markets are at the all time high and valuations are stretched.

- Do share your strategies to deal with such downturns.

References

Published Aug. 20, 2025, 4:19 p.m..